Everyone saving for retirement knows being proactive is very important. The concept of not preparing and relying on a government-sponsored retirement is a risky and unreliable practice. Having healthy retirement savings can help you live comfortably in your golden years. As stewards of our clients’ wealth, we get great satisfaction helping parents and grandparents contribute to their loved ones’ lives by properly gifting funds to a retirement account (if the loved one has earned income and qualifies). Funding retirement accounts at younger ages can increase the chances of a better funded and more comfortable financial situation during retirement.

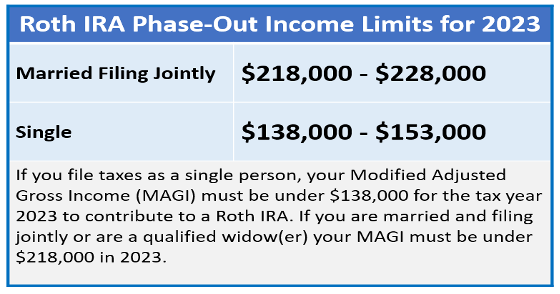

You can contribute to a 2023 IRA until the tax filing deadline of April 15, 2024. The annual contribution limit for 2023 is $6,500, or $7,500 if you are age 50 or older. Your ability to use a Roth IRA contribution can be limited based on your filing status and income (see box in this report). Now is a good time to consider making your 2023 retirement contributions.

For complete rules on Individual Retirement Accounts (IRAs), please visit www.irs.gov Publication 590a or call us to discuss this and all your retirement strategies. In the meantime, here is some information that you may find helpful.

Traditional IRAs

A traditional IRA (Individual Retirement Arrangement) is a way in which individuals can save for retirement and receive tax advantages. Traditional IRAs come in two varieties: deductible and nondeductible. Contributions to a traditional IRA may be fully or partially deductible, depending on your circumstances (i.e., taxpayer’s income, tax-filing status and other factors) and generally, amounts in a traditional IRA (including earnings and gains) are not taxed until distribution.

A clear advantage of traditional IRA accounts is the benefit of deferring taxes on all dividends, interest and capital gains earned inside the IRA account and the potential for annual tax-free compounding. This may allow an IRA to have a faster growth rate than a taxable account.

Roth IRA

A Roth IRA is an IRA that is subject to many of the same rules that apply to a traditional IRA with some major exceptions. Unlike traditional IRAs which can be tax deducted, you cannot deduct contributions to a Roth IRA. Some Roth IRA advantages include:

- If you satisfy the requirements, qualified distributions can be tax-free.

- You can leave funds in your Roth IRA for your entire lifetime.

- Beneficiaries inherit your Roth IRAs tax-free, if account requirements have been satisfied.

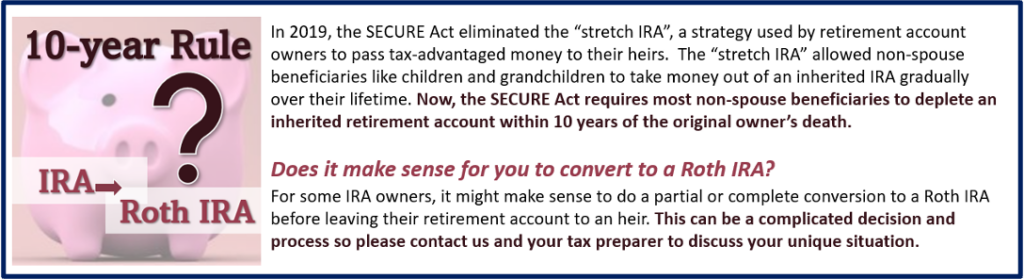

Many investors know and understand that the largest benefit of the Roth IRA is its tax-free withdrawal of contributions, interest and earnings in retirement, but Roth IRAs can be a powerful part of good estate planning.

Spousal IRA

If your spouse does not work, they can still fund a spousal traditional or Roth IRA. This allows non-wage-earning spouses to contribute to their own traditional or Roth IRA, provided the other spouse is working and the couple files a joint federal income tax return. If the working spouse is covered by a retirement plan at work, deductibility of contributions to a spousal traditional IRA would be phased out at higher incomes. Eligible married spouses can each contribute up to the contribution limit each year to their respective IRAs (spousal IRAs are also eligible for a $1,000 catch-up contribution for those 50 and older). To discuss spousal IRA strategies, call us.

Custodial IRA

Starting retirement savings early can allow the potential advantage of growing money in a tax efficient account over a long period of time. Many children work before age 18. Earned income makes them eligible to contribute to a Roth IRA, which can be a smart move for teenagers. This can also provide an excellent opportunity to teach or reinforce the importance of saving money.

Some of the rules regarding custodial Roth IRAs are:

- To be eligible to open a custodial Roth IRA, the child must meet all the same requirements as an adult. The minor must have earned income and contributions are limited to the lesser of total earned income for the year and the current maximum set by law, which for 2023 is $6,500 if you are under 50, and $7,500 if you are 50 or older.

- Adjusted gross income for the child must be below the thresholds above which Roth IRAs are not allowed.

- The Roth IRA must be managed for the benefit of the minor child.

- As the custodian, you make the decisions on investment choices—as well as decisions on if, why, and when the money might be withdrawn—until your child reaches “adulthood,” defined by age (usually between 18 and 21, depending on your state of residence). Once they reach that age, the account will then need to be re-registered in their name and it becomes an ordinary Roth IRA.

If you are the parent of a child who has earned income, a Custodial IRA can be a great way to teach the value of saving and investing. Besides getting a head start on saving, your child may be able to use the funds for college expenses—or even to buy a first home.

There are several ways to fund a Custodial Roth. For example, you can potentially use your annual ability to gift to children or grandchildren to make this happen. If your child or grandchild is earning money, call us to discuss options for setting up a Custodial Roth.

“Back-door” Roth IRA

The traditional contribution (“front door”) for Roth IRAs is currently not available for higher income earners. Married couples filing jointly earning $228,000 or more and single filers earning $153,000 or more in 2023 are still fully excluded from contributing directly to Roth IRAs.

Even though higher earners are ineligible to contribute to a Roth Ira, in 2010, Congress changed the rules and since then anyone can convert a traditional IRA to a Roth IRA. A Backdoor Roth IRA is a strategy for some higher income earners to participate in Roth IRAs. It is a strategy of contributing money into a traditional IRA and then rolling that into a Roth IRA, getting all the benefits. While this strategy sounds simple, there are several rules that you must know and follow to make sure you do not incur unintended tax consequences. This is where working with a knowledgeable financial or tax professional can provide guidance and value.

How Does the Backdoor Roth IRA Conversion Work?

The Backdoor Roth conversion can consist of two steps:

- You make a nondeductible contribution to your traditional IRA.

- Then, after consulting with your financial or tax professional, you convert this IRA into a Roth IRA.

There is one big caveat: this strategy may work best tax-wise for people who do not already have money in traditional IRAs. That is because in conversions, earnings and previously untaxed contributions in traditional IRAs are taxed—and that tax is figured based on all your traditional IRAs, even ones you are not converting. (Please read the section on the Pro Rata Rule.)

For an investor who does not already hold any traditional IRAs, creating one and then quickly converting it into a Roth IRA may incur little or no tax, because after a short holding period there is likely to be little or no appreciation or interest earned in the account. However, if you already have money in traditional deductible IRAs, you could face a

far higher tax bill on the conversion (again, this is covered later in the section on the Pro Rata Rule). If you choose to attempt a backdoor Roth IRA conversion, please consult a qualified tax planner prior to doing so as the rules for Roth conversions can be complicated.

Example of a Backdoor Roth IRA

Jane, a high-income earner, decides on January 2nd to put $6,500 into a traditional IRA. Jane’s income is too high to be able to deduct these contributions from her taxes. After consulting with a financial professional or tax advisor, she has no other IRAs and then converts the traditional IRAs to Roth IRAs completely tax-free. Her income is too high to make a direct contribution into a Roth IRA, but there is no income limit on conversions. Since Jane could not deduct the contribution anyway, she might as well get the advantage of never paying taxes on that money again available through the Roth IRA.

| Jane’s Backdoor Roth IRA Conversion (without Additional IRAs) | ||

| Contribution to non-deductible traditional IRA | Convert to Roth IRA | Income Subject to Taxation |

| $6,500 | $6,500 | $0 |

| This is a hypothetical example and is not representative of any specific investment. Your results may vary. | ||

Beware of the Pro Rata Rule for Roth Conversions

The Pro Rata rule for Roth conversions states that if you have any other deductible IRAs (i.e., a previous 401k that you have rolled over), the conversion of any contributions becomes a taxable event that you will need to pay taxes on upfront.

The Pro Rata rule for Roth conversions determines whether your conversion will be taxable. For taxation purposes, the IRS will look at your entire IRA holdings (even if they are in different accounts), not just the traditional IRA you are converting to a Roth IRA and will determine what your tax bill will be based upon a ratio of IRA assets that have already been taxed to those IRA assets in total.

The IRS determines the tax on this conversion based on the value of all your IRA assets. For example, Jim, a high-income earner, already has $93,500 in an IRA account, all of which has never been taxed. He decides on January 2nd to put $6,500 into a new traditional IRA. The next day he converts the new traditional non-deductible IRA to a Roth IRA. Jim’s income is too high to make a direct contribution into a Roth IRA, but there is no income limit on conversions. He has $93,500 in other IRAs (previously ALL non-taxed), so his total IRA assets are now $100,000. When he converts $6,500 to a Roth IRA, the IRS pro-rates his tax basis on the previous taxation of his total IRA assets, therefore making this conversion 93.5% taxable ($93,500/100,000 = 93.5%).

| Jim’s Backdoor Roth IRA Conversion | |||

| Prior Non-Taxed Balance in All IRAs | Contribution to Non-deductible traditional IRA | Convert to Roth IRA | Income Subject to Taxation |

| $93,500 | $6,500 | $6,500 | $6,077.50 |

| This is a hypothetical example and is not representative of any specific investment. Your results may vary. | |||

If you plan on using this backdoor IRA strategy, you want to be clear as to whether you have any other IRAs. As you can see, this can be a confusing area, and this is where we can help. If you are a high-income-earner we would be happy to review your situation to determine if this strategy is in your best interest. Also, please remember that your spouse’s IRA is separate from yours.

Am I a Candidate for a Backdoor Roth IRA?

Backdoor Roth IRAs can be appropriate for investors who:

- Only have retirement accounts through their jobs (i.e., 401k’s) and want to increase their retirement savings in tax-advantaged accounts, but whose income is too high to qualify for standard Roth IRA contributions; and

- Have the time and ability to wait for five years or until they are 59½, whichever is later, to avoid the 10% penalty on early withdrawals.

A Backdoor Roth IRA is probably not recommended if you:

- Do not want to contribute more than the maximum retirement limit through your workplace retirement account.

- Already have money in a traditional IRA and because of the Pro Rata rule may end up in a non-tax advantageous position when converting to a Backdoor Roth IRA.

- Plan or expect to withdraw the funds in the Roth IRA within the first five years of opening it. A Backdoor Roth is considered a conversion and not a contribution. Therefore, the funds may incur a 10% penalty if withdrawn within five years no matter your age.

- Are in a high tax bracket now and expect to be in a lower tax bracket in the future.

- Plan to relocate to a lower or no income tax state.

Note: While Backdoor Roth IRAs can be beneficial to many investors, they are not for everyone. They come with their limitations and complications. There are precautions that need to be taken to reap the full benefits of any financial decision. Please consult and review your situation with a qualified professional prior to choosing to use this strategy.

Conclusion

To further discuss funding your retirement plans, or to schedule a beneficiary review, please call us. This is an area where a highly informed financial professional can help you make an educated and calculated decision. As with all tax sensitive decisions, you should always consult with your financial and tax professional to help avoid tax ramifications.

Securities and investment advisory services offered through Osaic Wealth, Inc. member FINRA/SIPC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. This message and any attachments contain information, which may be confidential and/or privileged, and is intended for use only by the intended recipient, any review; copying, distribution or use of this transmission is strictly prohibited. If you have received this transmission in error, please (i) notify the sender immediately and (ii) destroy all copies of this message. If you do not wish to receive marketing emails from this sender, please reply to this email with the word REMOVE in the subject line.

This article is for informational purposes only. This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice as individual situations will vary. For specific advice about your situation, please consult with a lawyer, tax or financial professional. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax. Traditional IRA account owners should consider the tax ramifications, age and income restrictions in regard to executing a conversion from a Traditional IRA to a Roth IRA. The converted amount is generally subject to income taxation. The Roth IRA offers tax deferral on any earnings in the account. Withdrawals from the account may be tax free, as long as they are considered qualified. Limitations and restrictions may apply. Withdrawals prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Future tax laws can change at any time and may impact the benefits of Roth IRAs. Their tax treatment may change. IRA’s and ROTH conversions require understanding of specific rules, for complete rules on IRA’s (including who qualifies), please visit www.IRS.GOV Publication 590a or consult with a qualified professional. This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific situation with a qualified tax professional.

Source: www.irs.gov. Contents Provided by The Academy of Preferred Financial Advisors, Inc.